Posted November 10, 2025

By Today's Tech FWD

Altcoin Season Gets Political

Greg Guenthner:

Altcoin Season Finds a Political Spark as Trump-Linked Tokens Jump After U.S. Funding Deal

Altcoin season is reacting to Washington’s latest budget development, where the U.S. Senate passed a bill to fund the government and end a prolonged shutdown.

The move has injected a sense of relief into risk assets, especially in politically connected tokens such as WLFI and Official Trump. While crypto overall remains range-bound, these tokens have captured attention for reflecting sentiment shifts in the broader economy.

World Liberty Financial (WLFI) is currently trading near $0.159, up by 27% in the past 24 hours, with trading volume rising sharply compared with earlier in the week. The surge is connected to the improving confidence in U.S. governance following the Senate’s decision to approve temporary funding and reopen federal operations.

The Official Trump ($TRUMP) token is trading around $8.89, up by about 16% in the past 24 hours. The rise follows the same pattern as WLFI, supported by optimism surrounding U.S. fiscal stability and Trump-linked narratives.

If market calm holds through the next sessions, attention may shift from crisis avoidance to structural themes in altcoin season, such as fiscal direction, regulation, and policy-linked token narratives. For now, these two tokens capture how quickly political developments can ripple through speculative markets still sensitive to confidence and liquidity.

Davis Wilson:

Fed Governor Predicts Multi-Trillion Dollar Stablecoin Boom Will Force Down U.S. Interest Rates

Fed Governor Stephen I. Miran has warned that the explosive growth of stablecoins, dollar-pegged digital tokens now processing trillions of dollars in payments, could reshape global finance and exert long-term downward pressure on U.S. interest rates.

In a speech delivered at the BCVC Summit 2025 in New York, Miran said the rising demand for stablecoins is likely to increase purchases of U.S. Treasury securities and other liquid dollar assets. This, he argued, could mimic the effects of the early-2000s “global savings glut” that depressed rates worldwide.

“Stablecoins may become a multitrillion-dollar elephant in the room for central bankers,” Miran said. “Their growth increases the supply of loanable funds in the U.S. economy, placing downward pressure on the neutral interest rate.”

The Fed governor’s analysis suggests that even without further rate cuts, the rapid adoption of stablecoins could naturally exert downward pressure on borrowing costs.

Chris Campbell:

BitMine Stock Rises After Tom Lee’s Firm Buys the Dip, Adding $389 Million in Ethereum

Publicly traded Ethereum treasury company BitMine Immersion Technologies added 110,301 ETH — $389 million worth at the current price — to its holdings over the last week, the company announced Monday.

The company's portfolio includes over 3.5 million ETH — valued at about $12.4 billion as of this writing — along with 192 Bitcoin ($20.2 million worth) and $398 million in cash.

Ethereum has been sinking in recent weeks alongside the wider market, with the coin down nearly 15% over the last two weeks. It began to rebound on Sunday amid word that the U.S. government shutdown may soon be ending, but ETH has since pared back gains, showing only an 0.6% gain over the past 24 hours to a price of $3,528.

BitMine purchased 34% more ETH last week than the week prior, with Chairman Tom Lee attributing the larger buy to taking advantage of depressed prices.

"The recent dip in ETH prices presented an attractive opportunity and BitMine increased its ETH purchases this week," said Lee in a statement. BitMine now holds 2.9% of ETH's total supply, progressing toward the firm’s goal of acquiring 5%.

Sign Up Today for Free!

Today’s Tech FWD compiles all the best trading tips and market insights straight from our panel of distinguished analysts, including James Altucher, Ray Blanco, Chris Campbell, Greg Guenthner, Zach Scheidt and more.

Inside each issue, you'll find perspectives from our experts about speculative ways to trade, tech trends, crypto news and the latest AI opportunities so YOU can profit while the rest of the market is left behind.

Cybercrime's New Apex Predator

Posted November 14, 2025

By Today's Tech FWD

THC Gets Smoked by Shutdown Bill

Posted November 13, 2025

By Today's Tech FWD

France's Android Oppenheimers

Posted November 12, 2025

By Today's Tech FWD

Your Data, Now Stored in the Big Dipper

Posted November 07, 2025

By Today's Tech FWD

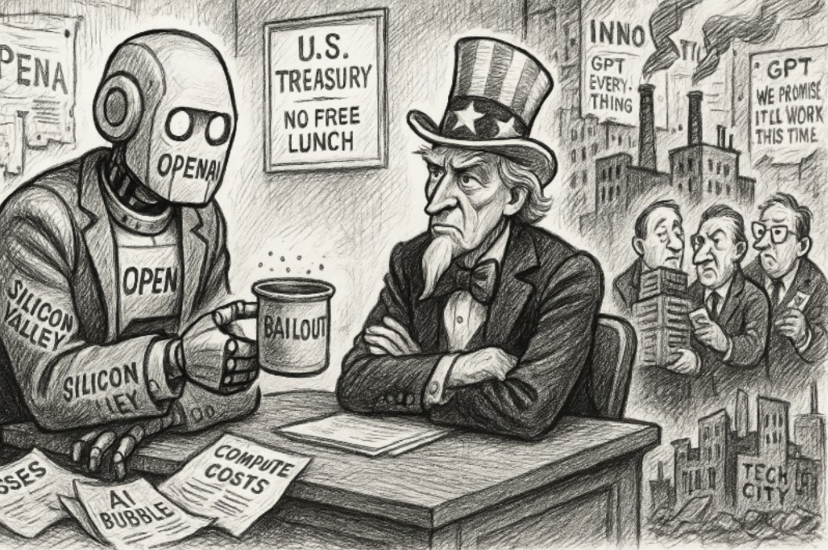

The AI Company That Wants You to Pay Its Bills

Posted November 06, 2025

By Today's Tech FWD